|

Some Quick Updates:

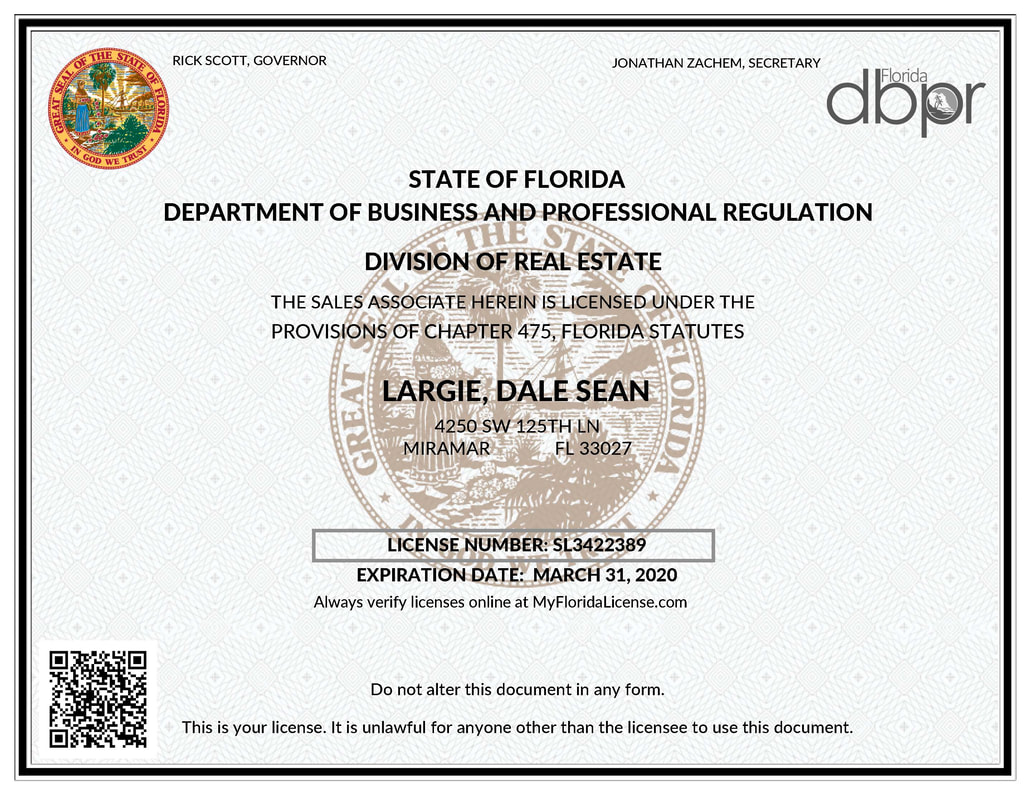

Child Tax Credit increase from $1,000 to $,2000! Remember, this is in addition to the $500 for dependents that didn't qualify for the Child Tax Credit. Not bad, huh? Of course not! Taxpayers with No Tax Due can still be eligible for a refund of up to $1,400! However, you will only get the refund - if you file a tax return. 401K contributions limit increased from $18,500 to $19,000! Take advantage. IRA contributions limit increased from $5,500 to $6,000! Take advantage. ITIN Folks - Make sure you renew asap or prior to year-end. One easy way to maximize your refund and avoid delays of receiving it is to merely have a folder or place where you keep all your current year tax documents, such as your 1095-A (healthcare), 1099-R (retirement), and if you're self-employed and do not have a bookkeeper - get one! You're throwing away money without knowing. Prior Year Tax Returns - if you have prior year tax returns that you need help with resolving issues associated with them, call us. We'll get it rectified for you. Simply send us an e-mail at [email protected] or call us at (786) 715-6781. If you haven't heard, yet, your favorite Accounting professional [Dale Largie, CPA] is now a licensed Realtor for the State of Florida.

Whether you're looking to buy, sell, lease, or rent, Dale Largie, CPA - The Realtor is here to help you reach your goals. The link to our secured real estate page is: https://www.taxlargierealtor.com/ There you may search for your new investment at your convenience. We look forward to working with you. "OMG! The tax extension deadline Pac-Man looking monster is coming to get me! Aaaahhhh!" Yep! That's what a lot of people are saying. Haha! Though we say it in jest, there are a lot of entrepreneurs having anxiety attacks, because the September 17, 2018 deadline is quickly approaching. Businesses that would be impacted include: Monday, 9/17/2018 –

In the following month, specifically October 15, 2018, additional tax filing deadlines will be chasing entrepreneurs and individuals as follows: Monday, October 15, 2018 -

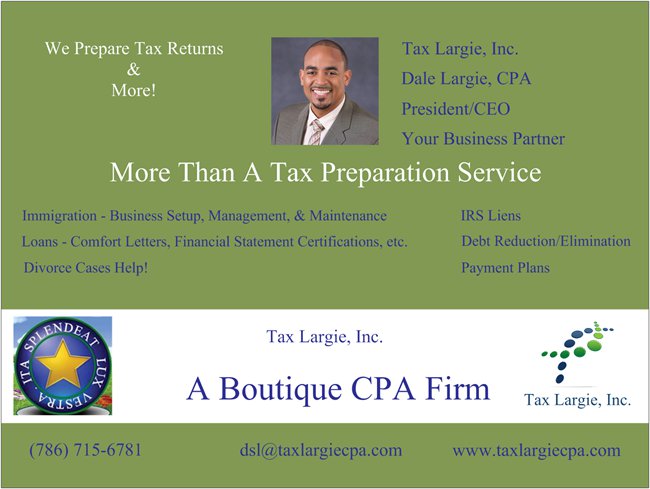

The solution is simple: Hire Tax Largie, Inc. Our fees starts at $43.75 weekly! Yes - no catch! Check out our Service Plan Fees tab for more details. After hiring us, you will have more time for vacations and spending time with the family and/or friends. More importantly, you'll be in compliance and not have the IRS on your back hounding you for payment; placing liens on your business; and sending you correspondence that depresses your day. What's the point of making money if you can't enjoy it? Tax Largie, Inc. will help you make extensions a thing of the past. Call us now at (786) 715-6781 or e-mail us at [email protected]. Let's talk!

Use Your Tax Refund to Buy A Property: |

Archives

January 2023

Categories |

RSS Feed

RSS Feed