|

As you are undoubtedly aware, e-filing tax returns begin January 27th, 2020. For those of you that will have a refund, Service provided a 'What to Expect for Refunds in 2019' that many of us taxpayers should keep in mind during this tax season.

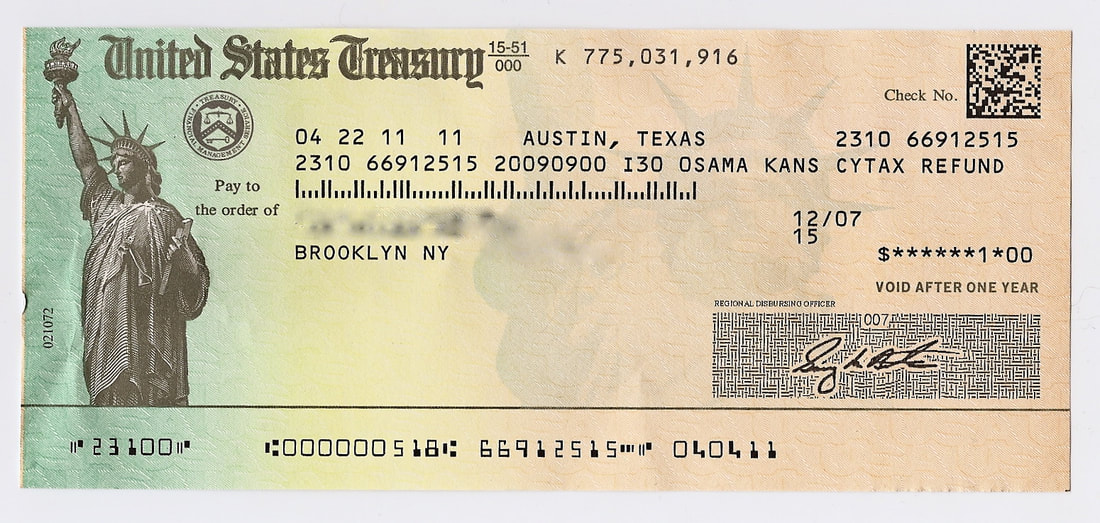

IRS: The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it’s possible your tax return may require additional review and take longer. Where’s My Refund? has the most up to date information available about your refund. The tool is updated daily so you don’t need to check more often. Direct Deposit Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. It's the safest, fastest way to receive your refund and is also easy to use. Your refund should only be deposited directly into accounts that are in your own name; your spouse’s name or both if it’s a joint account. No more than three electronic refunds can be deposited into a single financial account or pre-paid debit card. Taxpayers who exceed the limit will receive an IRS notice and a paper refund. Whether you file electronically or on paper, direct deposit gives you access to your refund faster than a paper check. Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding If you requested a refund of tax withheld on a Form 1042-S by filing a Form 1040NR, we will need additional time to process the return. Please allow up to 6 months from the original due date of the 1040NR return or the date you actually filed the 1040NR, whichever is later to receive any refund due. The word is out! Everyone is talking about it; some are screaming it; but it's all the same news: The IRS announced today that the nation's tax season will start for on Monday, January 27, 2020! ARE YOU READY? Ensure to give your Tax Professional all required documents and information needed to e-file an accurate tax return - the first time. Please have a conversation with your CPA and notify him/her of any changes in your life since the last tax return (newborn, new home, new business, marital status, relocation, etc.). IP PIN - If you received an IP PIN, your tax professional will need it to file your tax returns. "The IP PIN is a six-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number on fraudulent federal income tax returns. An IP PIN helps the IRS verify a taxpayer's identity and accept their electronic or paper tax return." (IRS). FBAR - Report of Foreign Bank and Financial Accounts (FBAR)A United States person, including a citizen, resident, corporation, partnership, limited liability company, trust and estate, must file an FBAR to report:

Entrepreneurs Entrepreneurs should ensure their estimated tax payments, payroll tax deposits and all related liabilities, income tax payments are current and reflected in your respective bookkeeping.

|

Archives

January 2023

Categories |

RSS Feed

RSS Feed