|

Tax season 2023 starts January 23rd, 2023. This is the date the IRS will start accepting and processing applications. Everyone should make a list of all the documents needed to file a complete and accurate tax return. Failure to do this on the initial filing will result in delays in processing your tax return and/or refund, if applicable. Your Online Account It is highly recommended that you have access to your IRS Online Account. If you haven’t created your online account yet, you should do it now. It will help your tax filing experience less painful. Your online account allows you to access your tax records, view your balances by year, apply for payment plans or view plan details if you have an existing payment plan, make payments on balances owed, view tax professional authorizations, and view important communications from the IRS specific to your account. Do it now! Go to www.irs.gov/account Beware of False Prophets Remember NO ONE can tell what the results of your tax return will be BEFORE preparing your tax return. Frankly, if they were psychic, they should have won that MEGA Million of $1.35 BILLION dollars and leave the “Small Change” to the other folks like you and I. Form 1099-K: Payment Card and Third Party Network Transactions A lot of folks were a bit nervous about the reporting requirement of third-party settlement organizations that the IRS changed to $600 from $20,000, while eliminating the 200 transactions threshold. Folks, if you’re running a business, you should be reporting the business activity – regardless of the amount. If the amount shown on the Form 1099-K is a non-business transaction, you should contact the Filer to have it adjusted. Credits This will be disappointing for some individual tax payers who received CTC, EITC, and CDCC. Per the IRS, check this out:

Ouch! I can hear the noise already. Businesses To my business entities, here are some tax tips to improve your business' tax filing experience:

Real Estate

Folks in the business of Real Estate should ensure they have good records. This is a complicated business and you should ensure you have a CPA in your corner assisting with the Bookkeeping, Accounting, and filing of the related taxes. Otherwise, you may be at risk of paying unnecessary taxes. KEY POINT: Exemption on the sale of a home is applicable on your main home, only. Luckily, Realtor Largie is also a CPA :) I can help. Let's talk.

0 Comments

Deadlines are approaching quickly! Are you ready?

If you think I’m talking about the Monster Jam on August 6th at the FLA Live Arena, Sunrise, FL. I'm not! If you think I’m referring to the Beres Hammond Solid Love 2022 concert on September 3rd at the Au-Rene Theatre at the Broward Center, I'm not! If you think I’m talking about the Master P's No Limit Reunion Tour on September 16 at the FLA Live Arena, I'm not! I’m referring to your tax deadline to file your U.S. tax return:

Service Plans - Business Solutions for Business Owners Tax Largie, Inc’s Service Plans were designed to provide affordable business solutions to small businesses that include Bookkeeping, Payroll Management, Sales Tax Management, Financial Reporting and Tax Preparation. Contact Us! We'd love to help! It's been a while, but all for good reason. Among many other of life's demands, my pursuit to provide you with value continues. I decided to pursue a certification in Short Sales and Foreclosures (SFR).

Some homeowners will experience challenges along the way. While those challenges may appear to be cripplingly unwelcomed, all is not lost. Realtor Largie can help mitigate those losses and help you through these tough times. Let's talk! Home prices! Wow! Did you notice the price of real estate increasing? Of course you did! Did you sell? If so, you probably made a lot of money. HINT: Call your CPA and discuss tax implications NOW! Don't wait until the year is over and say, "Oh, I forgot to tell you. I sold my house for $1.5M that we bought for $400K." He or she will probably say, "Congratulations! Let's talk about how much you may have to pay in taxes." Of course, Realtor Largie is a CPA, so you and I would have that conversation automatically. With all the talks about the soaring home prices, inflation, recession, and the like, the real estate market could have significant tax implications for all stakeholders. It’s best to talk to your CPA and plan ahead, as the lack tax planning could cost you (seller) a lot of money. Always remember to keep good records. As the ‘tables turn’ on the sellers’ market, here are some tax benefits that you should consider: Deductible Expenses

On The Horizon: First Time Homebuyer Program

The Small Business Association (SBA) is currently offering Payroll Protection Program (PPP) loans until May 31, 2021. If the PPP funds are used as intended, it is 100% forgivable.

The SBA is also accepting applications for the Economic Injury Disaster Loan (EIDL), with rates of 3.75% for businesses fixed; 2.75% for nonprofits (fixed); 30-years term and no prepayment penalties or fees. Let’s Talk PPP: DO NOT wait until the last minute to apply. Most lenders will stop accepting applications a few weeks out, if not already. Apply now! It’s a good idea to get your business professional involved in the application process. Here’re some additional details provided by the SBA that you should be aware of: First Draw - Loan details PPP is a loan designed to provide a direct incentive for small businesses to keep their workers on payroll. First Draw PPP loans can be used to help fund payroll costs, including benefits, and may also be used to pay for mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations. SBA will forgive loans if all employee retention criteria are met, and the funds are used for eligible expenses.

The following entities affected by COVID-19 may be eligible:

Second Draw - Loan Details PPP now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP loan with the same general loan terms as their First Draw PPP loan. Second Draw PPP loans can be used to help fund payroll costs, including benefits. Funds can also be used to pay for mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations. Maximum loan amount and increased assistance for accommodation and food services businesses. Who May Qualify A borrower is generally eligible for a Second Draw PPP loan if the borrower:

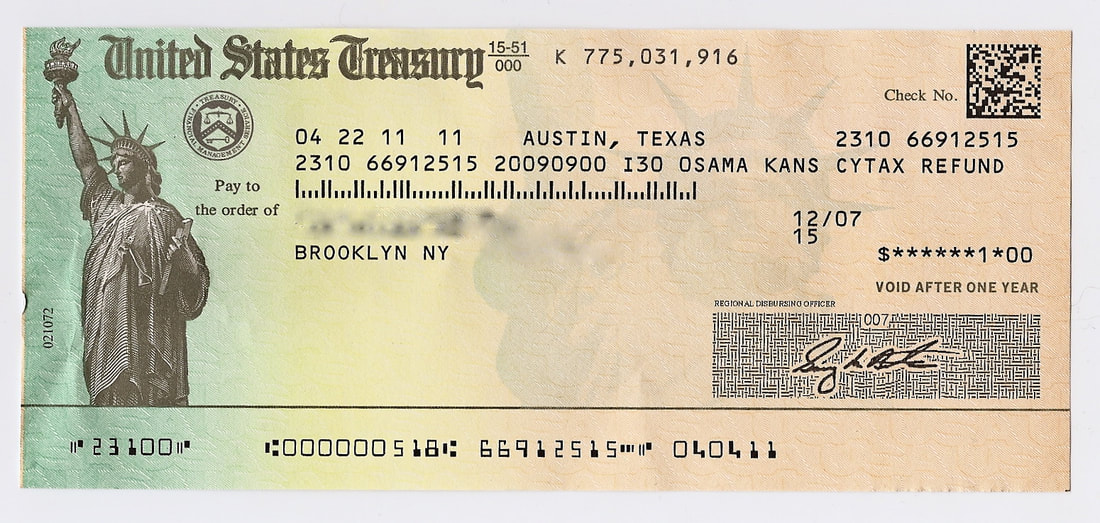

CNN, as with several other platforms, provided needed information for the those that are experiencing homelessness and are at high risk of not receiving their $1,400 stimulus - even though they are eligible.

In-Person Assistance The IRS also offers in-person assistance programs free of charge. It helps you to get assistance from a provider in your zip code. United Way The United Way has a website dedicated to pandemic-related financial help. People can also call the United Way's 211 Economic Impact Payment Helpline at 844-322-3639. No Fixed Address Without a fixed address, filing taxes -- and receiving the stimulus payment you're filing for -- is challenging, but not impossible. Free tax resources and trained volunteers can help determine which address would be best to include on tax forms, whether it be a PO box, or the address of a friend or relative. The Consumer Financial Protection Bureau lists a number of options for IRS mail correspondence, including shelters, service providers or places of worship that hold mail for clients; friends or relatives; rented mailboxes or even, as a last resort, General Delivery, a USPS service which offers a temporary mailing address. Prepaid Debit Card Without bank account information, the IRS may issue stimulus payments in the form of Economic Impact Payment (EIP) cards. Information about EIP cards related to the most recent stimulus package is a viable option, the IRS will still need a physical address to send EIP debit cards. Many previously ineligible folks will now be eligible for the PPP loan, thanks to the Biden Administration taking steps to promote equitable access to SBA relief. Here's what the SBA posted below: Specifically, on Wednesday, February 24, 2021 at 9 am ET, SBA will establish a 14-day, exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employees. This will give lenders and community partners more time to work with the smallest businesses to submit their applications, while also ensuring that larger PPP-eligible businesses will still have plenty of time to apply for and receive support before the program expires on March 31, 2021. SBA also announced four additional changes to open the PPP to more underserved small businesses than ever before. While these changes are being implemented, SBA will work with community partners to improve the emergency relief “digital front door” and conduct extensive stakeholder outreach. And, SBA will strengthen its relationships with lender partners to advance equity goals, deliver funding efficiently, and prevent fraud, waste, and abuse. SBA will:

Due to the limited timeframe and the many that could benefit from these changes, it's critical that this information is shared with everyone.

Seasons Greetings, The year 2020 is like no other year I've experience. How about you? Unfortunately, some things never change and taxes is one of them. With that said, here are some quick tips to consider as we go through the holidays and right into 2021 tax filing season:

STIMULUS PACKAGE

As you can see, the biggest beneficiaries of the stimulus package were businesses who employed staff to fulfill the business' purpose. Note, however, Sole Proprietors, Independent Contractors, and Self-Employed individuals may also be eligible to apply and receive a forgivable loan. We are experiencing some difficult economic times, so ensure to make use of any opportunity available to mitigate those difficult circumstances. By now many of you have heard of the Paycheck Protection Program aka PPP Loan and the Economic Injury Disaster Loan and Advance aka EIDL Loan.

Paycheck Protection Program Loan “The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll.” (SBA) If you had no one on payroll, you effectively sold yourself short. Economic Injury Disaster Loan and Advance "In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories were able to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance is designed to provide economic relief to businesses that are currently experiencing a temporary loss of revenue. This loan advance will not have to be repaid." (SBA) If you had no bookkeeping or accounting records, you effectively sold yourself short. Without proper bookkeeping, it would be difficult to determine one’s compensation, payroll expenses, or pinpoint the degree by which your business was negatively and temporarily impacted by COVID-19. Moreso, those records would be based on historical data, filing, and related expenses already paid. Congratulations to the 430,906 recipients of the $37,869,479,978 (SBA Report May 23, 2020). Affordable bookkeeping plans are available at Tax Largie, Inc. Service Plans for Business Owners. Take advantage of our low monthly fees. Mistakes are merely a lesson if we learned from it. If you were left out of the $37,869,479,978, get a bookkeeper and ensure that doesn't happen again. The IRS announced Friday that taxpayers will start receiving those Economic Payments - starting next week. Here's an abridged version of what to expect per the Service.

The Treasury Department and the Internal Revenue Service launched a new web tool allowing quick registration for Economic Impact Payments for those who did not file a tax return for tax years 2018 or 2019 and those that don’t normally file a tax return, which includes:

NOTE: If someone else claimed you on their tax return, you will not be eligible for the Economic Impact Payment or using the Non-Filer tool. Using the Non-Filer to get your payment will not result in any taxes being owed. Entering bank or financial account information will allow the IRS to deposit your payment directly in your account. Otherwise, your payment will be mailed to you. Amounts Payment of up to $1,200 for individuals or $2,400 for married couples and $500 for each qualifying child. Individuals who receive Social Security retirement, survivors or disability benefits, SSDI or who receive Railroad Retirement benefits but did not file a return for 2019 or 2018 will automatically receive a payment later. Get My Payment Tool To help everyone check on the status of their payments, the IRS is building a second new tool expected to be available for use by April 17. Get My Payment will provide people with the status of their payment, including the date their payment is scheduled to be deposited into their bank accounts or mailed to them. An additional feature on Get My Payment will allow eligible people a chance to provide their bank account information so they can receive their payment more quickly rather than waiting for a paper check. This feature will be unavailable if the Economic Impact Payment has already been scheduled for delivery. Small/Midsize Businesses: Paid Leave for Workers and Business Tax Credits for Small Businesses3/22/2020

WASHINGTON — The U.S. Treasury Department, Internal Revenue Service (IRS), and the U.S. Department of Labor (Labor) announced that small and midsize employers can begin taking advantage of two new refundable payroll tax credits, designed to immediately and fully reimburse them, dollar-for-dollar, for the cost of providing Coronavirus-related leave to their employees. This relief to employees and small and midsize businesses is provided under the Families First Coronavirus Response Act (Act), signed by President Trump on March 18, 2020.

The Act will help the United States combat and defeat COVID-19 by giving all American businesses with fewer than 500 employees funds to provide employees with paid leave, either for the employee's own health needs or to care for family members. The legislation will enable employers to keep their workers on their payrolls, while at the same time ensuring that workers are not forced to choose between their paychecks and the public health measures needed to combat the virus. Key Takeaways:

BACKGROUND The Act provided paid sick leave and expanded family and medical leave for COVID-19 related reasons and created the refundable paid sick leave credit and the paid child care leave credit for eligible employers. Eligible employers are businesses and tax-exempt organizations with fewer than 500 employees that are required to provide emergency paid sick leave and emergency paid family and medical leave under the Act. Eligible employers will be able to claim these credits based on qualifying leave they provide between the effective date and December 31, 2020. Equivalent credits are available to self-employed individuals based on similar circumstances. PAID LEAVE The Act provides that employees of eligible employers can receive two weeks (up to 80 hours) of paid sick leave at 100% of the employee's pay where the employee is unable to work because the employee is quarantined, and/or experiencing COVID-19 symptoms, and seeking a medical diagnosis. An employee who is unable to work because of a need to care for an individual subject to quarantine, to care for a child whose school is closed or child care provider is unavailable for reasons related to COVID-19, and/or the employee is experiencing substantially similar conditions as specified by the U.S. Department of Health and Human Services can receive two weeks (up to 80 hours) of paid sick leave at 2/3 the employee's pay. An employee who is unable to work due to a need to care for a child whose school is closed, or child care provider is unavailable for reasons related to COVID-19, may in some instances receive up to an additional ten weeks of expanded paid family and medical leave at 2/3 the employee's pay. PAID SICK LEAVE CREDIT For an employee who is unable to work because of Coronavirus quarantine or self-quarantine or has Coronavirus symptoms and is seeking a medical diagnosis, eligible employers may receive a refundable sick leave credit for sick leave at the employee's regular rate of pay, up to $511 per day and $5,110 in the aggregate, for a total of 10 days. For an employee who is caring for someone with Coronavirus, or is caring for a child because the child's school or child care facility is closed, or the child care provider is unavailable due to the Coronavirus, eligible employers may claim a credit for two-thirds of the employee's regular rate of pay, up to $200 per day and $2,000 in the aggregate, for up to 10 days. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period. CHILD CARE LEAVE CREDIT In addition to the sick leave credit, for an employee who is unable to work because of a need to care for a child whose school or child care facility is closed or whose child care provider is unavailable due to the Coronavirus, eligible employers may receive a refundable child care leave credit. This credit is equal to two-thirds of the employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up to 10 weeks of qualifying leave can be counted towards the child care leave credit. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period. PROMPT PAYMENT FOR THE COST OF PROVIDING LEAVE When employers pay their employees, they are required to withhold from their employees' paychecks federal income taxes and the employees' share of Social Security and Medicare taxes. The employers then are required to deposit these federal taxes, along with their share of Social Security and Medicare taxes, with the IRS and file quarterly payroll tax returns (Form 941 series) with the IRS. Under guidance that will be released next week, eligible employers who pay qualifying sick or child care leave will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and child care leave that they paid, rather than deposit them with the IRS. The payroll taxes that are available for retention include withheld federal income taxes, the employee share of Social Security and Medicare taxes, and the employer share of Social Security and Medicare taxes with respect to all employees. If there are not sufficient payroll taxes to cover the cost of qualified sick and child care leave paid, employers will be able file a request for an accelerated payment from the IRS. The IRS expects to process these requests in two weeks or less. The details of this new, expedited procedure will be announced next week. EXAMPLES If an eligible employer paid $5,000 in sick leave and is otherwise required to deposit $8,000 in payroll taxes, including taxes withheld from all its employees, the employer could use up to $5,000 of the $8,000 of taxes it was going to deposit for making qualified leave payments. The employer would only be required under the law to deposit the remaining $3,000 on its next regular deposit date. If an eligible employer paid $10,000 in sick leave and was required to deposit $8,000 in taxes, the employer could use the entire $8,000 of taxes in order to make qualified leave payments and file a request for an accelerated credit for the remaining $2,000. Equivalent child care leave and sick leave credit amounts are available to self-employed individuals under similar circumstances. These credits will be claimed on their income tax return and will reduce estimated tax payments. SMALL BUSINESS EXEMPTION Small businesses with fewer than 50 employees will be eligible for an exemption from the leave requirements relating to school closings or child care unavailability where the requirements would jeopardize the ability of the business to continue. The exemption will be available on the basis of simple and clear criteria that make it available in circumstances involving jeopardy to the viability of an employer's business as a going concern. Labor will provide emergency guidance and rulemaking to clearly articulate this standard. NON-ENFORCEMENT PERIOD Labor will be issuing a temporary non-enforcement policy that provides a period of time for employers to come into compliance with the Act. Under this policy, Labor will not bring an enforcement action against any employer for violations of the Act so long as the employer has acted reasonably and in good faith to comply with the Act. Labor will instead focus on compliance assistance during the 30-day period. As we expected, the Service has 'chipped in' and extended Tax Day from April 16th, 2020 to July 15th, 2020. Thank you! Here are some additional information from the Service that many of us may find useful:

The IRS urges taxpayers who are due a refund to file as soon as possible. Most tax refunds are still being issued within 21 days. Tax Largie, Inc. is practicing Social Distancing, too. It's the right thing to do! Therefore, we will be processing tax returns from documents received through electronic media: email, text, etc. We're doing our part to prevent the spread of COVID-19. If you have any questions, please contact us at (786) 715-6781 or dsl@taxlargiecpa.com Be safe! How many of you have asked the "Money" questions, "Where's my refund?" The IRS may be able to shed some light on this. Taxpayers who claim the Earned Income Tax Credit or the Additional Child Tax Credit may experience a refund hold. According to the Protecting Americans from Tax Hikes (PATH) Act, the IRS cannot issue these refunds before mid-February. The IRS expects the first EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Check Where’s My Refund for your personalized refund date. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 22. So EITC /ACTC filers will not see an update to their refund status for several days after Feb. 15. The IRS, tax preparers and tax software will not have additional information on refund dates, so Where’s My Refund? remains the best way to check the status of a refund. Where’s My Refund? is only updated once daily, usually overnight, so you don’t need to check the status more often. Why is my refund being held?If you claim the EITC or ACTC on your tax return, the IRS cannot issue your refund before mid-February. The law requires the IRS to hold the entire refund — even the portion not associated with the EITC or ACTC. Like previous years, some tax refunds may be held if there are questions about the tax return or the IRS needs more information. When will I get my refund?The IRS expects the first EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Check Where’s My Refund for your personalized refund date. Tax Largie, Inc.'s nationwide tax preparation service is available to assist you with your current, prior years, and future years tax prep and filing. Contact us; we can help!

As you are undoubtedly aware, e-filing tax returns begin January 27th, 2020. For those of you that will have a refund, Service provided a 'What to Expect for Refunds in 2019' that many of us taxpayers should keep in mind during this tax season.

IRS: The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it’s possible your tax return may require additional review and take longer. Where’s My Refund? has the most up to date information available about your refund. The tool is updated daily so you don’t need to check more often. Direct Deposit Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. It's the safest, fastest way to receive your refund and is also easy to use. Your refund should only be deposited directly into accounts that are in your own name; your spouse’s name or both if it’s a joint account. No more than three electronic refunds can be deposited into a single financial account or pre-paid debit card. Taxpayers who exceed the limit will receive an IRS notice and a paper refund. Whether you file electronically or on paper, direct deposit gives you access to your refund faster than a paper check. Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding If you requested a refund of tax withheld on a Form 1042-S by filing a Form 1040NR, we will need additional time to process the return. Please allow up to 6 months from the original due date of the 1040NR return or the date you actually filed the 1040NR, whichever is later to receive any refund due. The word is out! Everyone is talking about it; some are screaming it; but it's all the same news: The IRS announced today that the nation's tax season will start for on Monday, January 27, 2020! ARE YOU READY? Ensure to give your Tax Professional all required documents and information needed to e-file an accurate tax return - the first time. Please have a conversation with your CPA and notify him/her of any changes in your life since the last tax return (newborn, new home, new business, marital status, relocation, etc.). IP PIN - If you received an IP PIN, your tax professional will need it to file your tax returns. "The IP PIN is a six-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number on fraudulent federal income tax returns. An IP PIN helps the IRS verify a taxpayer's identity and accept their electronic or paper tax return." (IRS). FBAR - Report of Foreign Bank and Financial Accounts (FBAR)A United States person, including a citizen, resident, corporation, partnership, limited liability company, trust and estate, must file an FBAR to report:

Entrepreneurs Entrepreneurs should ensure their estimated tax payments, payroll tax deposits and all related liabilities, income tax payments are current and reflected in your respective bookkeeping.

Here's wishing all of you a happy holiday! May the spirit of Christmas 2019 bless you and others; and may your New Year 2020 be filled with continued blessings.

Happy Holidays! Tax Largie, Inc. Let’s just jump right into it. Extension Deadline – Tuesday,10/15/2019

Whether you drive the Maserati Alfieri, Telsa, or the BMW 740e, the IRS allows a tax credit for vehicles acquired after December 31, 2009. The credit is equal to $2,500 plus, for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity, $417, plus an additional $417 for each kilowatt hour of battery capacity in excess of 5 kilowatt hours. The total amount of the credit allowed for a vehicle is limited to $7,500. Micro-Captive Insurance Watch out! Micro-Captive Insurance is an effective strategy to save money – if used correctly! Tax law generally allows businesses to create "captive" insurance companies to protect against certain risks. Under section 831(b) of the Internal Revenue Code, certain small insurance companies can choose to pay tax only on their investment income. However, be careful! In abusive "micro-captive" structures, promoters, accountants or wealth planners persuade owners of closely held entities to participate in schemes that lack many of the attributes of genuine insurance. Unfortunately, those individuals engaging in this abusive practice is being hunted by the IRS. First Time Home Buyers Did You Know you could use your 401(k) savings to Buy Your First Home – without an early distribution penalty? Absolutely! Call your broker to find out more details about this. If they confirm, then your next call should be me, Realtor Largie! Realtor Largie will find you a home for you and the family, asap! Entreprenuers Self-employed folks, remember Realtor Largie is also a CPA. You're in excellent hands in Largie's world :) As the last quarter of 2019 winds down, there have been some tax updates that you should know. Straight from the Service, check these updates below. TAX TIPS, 2019:

Now that we've gotten the tax reminders and home-buying stuff out the way, who's down for a Jerk Chicken dinner with Realtor Largie?

Have a GREAT day folks! Thank You!

2018 tax season was challenging for many due to the impact of the TCJA and the new tax laws associated with it. Though it was a tough road for many, some had the best tax season they have ever had. Why? Simply put - they were prepared. Tax planning can go a long way and save you a lot of money. Thank you goes out to everyone that chose Tax Largie, Inc. as their business professional of choice. I look forward to working with you all, soon. You should have all filed your Business Tax Returns by now. If not, what are you waiting for? I hope you're not saying, "Oh, I'll just filed an extension - again!" If that's your thought, then shame on you. Business Tax Returns Due: Partnership returns are due March 15th! S-Corporations returns are due March 15th! You have until Friday, folks! Let's get to work. Tax Largie, Inc. is here to help! Contact us!

That's right folks! With the right tax professional, you stand a chance of benefiting from several tax credits available to you, both from a business and individual tax credit perspective.

Hopefully, your Business Tax Professional is familiar with all those credits and seek to ensure you receive every penny you are eligible for and deserve to receive. Yes, the work can be time-consuming; may require higher level tax knowledge; may cost a little more in fees, but it's well worth the benefit of it being done right. Tax Largie, Inc. is available to assist you with your tax preparation needs, both business taxpayers and individual taxpayers. Contact us; we can help!

"Oh, snap! Tax season is here again!" That's right folks! It's time to e-file your tax returns, starting January 28, 2019. Everyone is worried about the government shutdown and how it will affect their tax refunds this filing season. In summary, the IRS will begin accepting tax returns as of January 28th, 2019! Likewise, "The filing deadline to submit 2018 tax returns is Monday, April 15, 2019 for most taxpayers. Because of the Patriots’ Day holiday on April 15 in Maine and Massachusetts and the Emancipation Day holiday on April 16 in the District of Columbia, taxpayers who live in Maine or Massachusetts have until April 17, 2019 to file their returns." (IRS) Noteworthy, the IRS will be waiving, "...the estimated tax penalty for many taxpayers whose 2018 federal income tax withholding and estimated tax payments fell short of their total tax liability for the year." (IRS). Therefore, if you were one of those individuals that did not adjust your withholding to accommodate the tax changes provoked by the TCJA on December 2017, you're in luck - this year! Because of the unpredictable nature of the government shutdown, changes could possibly occur. An update will be given should that happen. Entrepreneurs, there are a lot changes happening for you this year. In short, get a CPA. It's time! Tax Largie, Inc. is available to assist you with your bookkeeping, payroll, business and individual tax preparation needs. You may also visit our Service Plan Fees tab for services that suit your business. Then, let's talk about getting you started. Contact us!

Have a Great Season! Some Quick Updates:

Child Tax Credit increase from $1,000 to $,2000! Remember, this is in addition to the $500 for dependents that didn't qualify for the Child Tax Credit. Not bad, huh? Of course not! Taxpayers with No Tax Due can still be eligible for a refund of up to $1,400! However, you will only get the refund - if you file a tax return. 401K contributions limit increased from $18,500 to $19,000! Take advantage. IRA contributions limit increased from $5,500 to $6,000! Take advantage. ITIN Folks - Make sure you renew asap or prior to year-end. One easy way to maximize your refund and avoid delays of receiving it is to merely have a folder or place where you keep all your current year tax documents, such as your 1095-A (healthcare), 1099-R (retirement), and if you're self-employed and do not have a bookkeeper - get one! You're throwing away money without knowing. Prior Year Tax Returns - if you have prior year tax returns that you need help with resolving issues associated with them, call us. We'll get it rectified for you. Simply send us an e-mail at dsl@taxlargiecpa.com or call us at (786) 715-6781. If you haven't heard, yet, your favorite Accounting professional [Dale Largie, CPA] is now a licensed Realtor for the State of Florida.

Whether you're looking to buy, sell, lease, or rent, Dale Largie, CPA - The Realtor is here to help you reach your goals. The link to our secured real estate page is: https://www.taxlargierealtor.com/ There you may search for your new investment at your convenience. We look forward to working with you. |

Archives

January 2023

Categories |

RSS Feed

RSS Feed